Take Control of Your Debt — Settle Smarter.

The Do-It-Yourself Debt Settlement Playbook walks you step-by-step through the proven

10-Phase System for settling credit card debt legally, confidently, and on your own terms.

only

$69.95

Why You Don’t Need a Debt Company to Settle Your Debt

Most people in debt believe they have only two options: bankruptcy or paying every cent back with interest. – That’s simply not true.

Debt settlement — also called debt negotiation — lets you pay less than the full balance you owe in exchange for clearing your account. In fact, people regularly reduce their credit card balances by 40–80% using the same tactics debt firms charge thousands to perform.

But here’s the secret: those companies don’t do anything you can’t do yourself.

They typically charge 15–25% of your total debt — just to make the same phone calls and send the same letters you’ll find in this Playbook. They also drag the process out for years, risking lawsuits and further credit damage along the way.

The SettleSmart system gives you the same strategy — without the middleman, the fees, or the fear.

What You’ll Learn

Master the 10-Phase System Inside the Playbook

Understanding Debt Settlement

Preparing Your Finances

Starting Negotiations

Making the Payment Safely

Rebuilding Credit

Legal & Tax FAQs

Templates & Letters

State-by-State Rules

Success Stories

Your Action Plan

You asked. We answer in the playbook.

- "How to write a debt settlement letter to my bank or credit card company?"

- "What percentage should I offer to settle a $10k credit card debt?"

- "Is DIY debt settlement legal in my state?"

- "How much does credit card debt settlement hurt my credit score?"

- "Should I use a debt settlement company or do it myself?"

- "What are the tax implications of settling credit card debt?"

- "Can I negotiate with debt collectors after charge-off?"

- "How many months of missed payments before negotiating debt?"

- "Can I negotiate with debt collectors after charge-off?"

- "What happens if I miss a payment on a debt settlement plan?"

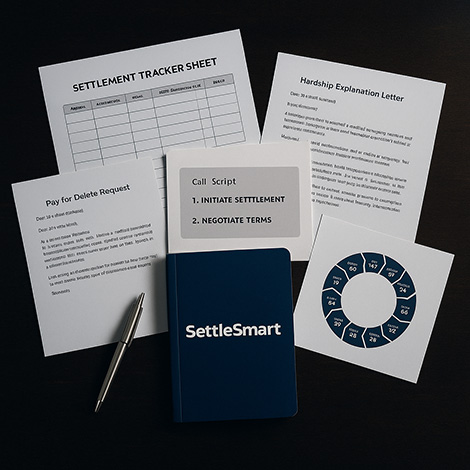

Toolkit Highlights

Includes Every Script, Checklist, and Letter You’ll Need

What you Get

- Settlement Tracker Sheet

- Debt Offer & Cease-and-Desist Templates

- Hardship Letter Examples

- Step-by-Step Call Scripts

- 10-Phase Timeline Map

WHAT TO EXPECT

No subscriptions.

No hidden fees.

Just the knowledge and tools you need to negotiate like a pro.

Customer Testimonials

playbooks sold

money saved (est)

Purchase the Playbook

About the Author

I’ve been through this process more than once — and I know exactly how it feels to be overwhelmed, frustrated, and unsure where to start. SettleSmart was built from real experience, not theory. Every tactic and template inside has been tested in real negotiations, with real creditors, and real results.

When I first faced my own debt challenges, I made mistakes, learned the hard way, and discovered how much power we actually have when we understand how the system works. I started sharing what I learned with friends and colleagues — helping them settle thousands in debt, rebuild their credit, and move forward with confidence.

This Playbook is the result of those lessons. It’s not about tricks or loopholes — it’s about clarity, confidence, and a proven process that works. My goal is to help you take back control of your finances and experience the same sense of freedom I did when I finally became debt-free.

Frequently Asked Questions

Can I really settle my own credit card debt without a company?

Yes — and that’s exactly what the Do-It-Yourself Debt Settlement Playbook teaches you. Creditors are often willing to settle directly with consumers, especially once accounts reach 90-180 days past due. With the right strategy and templates, you can negotiate your own settlement and keep 100 % of the savings.

Will settling my debt hurt my credit?

Debt settlement affects your score temporarily, but it’s far less damaging than bankruptcy or years of missed payments. Most people begin rebuilding within 12-18 months after settlement. The Playbook shows you how to recover smartly — from “settled” account reporting to rebuilding with secured credit cards and on-time payments.

Can creditors still sue me if I’m trying to settle?

Technically yes, but it’s rare when you’re communicating in good faith. Most creditors prefer a negotiated payment over legal action. The Playbook explains how to handle legal notices, what your rights are under the Fair Debt Collection Practices Act, and how to stay proactive before anything escalates.

Why choose SettleSmart instead of a debt relief company?

Because you’ll save thousands in unnecessary fees. Debt companies often charge 15 – 25 % of your total debt just to follow the same steps outlined in the Playbook. SettleSmart gives you every script, letter, and checklist to do it yourself — legally, confidently, and affordably.

How long does debt settlement take?

Most settlements occur within 3-6 months per creditor. The SettleSmart 10-Phase System breaks the process into predictable stages — from your first missed payment to your final “paid in full” letter — so you always know where you stand.

Do I have to pay taxes on forgiven debt?

If more than $600 is forgiven, the creditor may issue IRS Form 1099-C. However, many people qualify for the insolvency exclusion using IRS Form 982 — meaning you may not owe any tax. The Playbook walks you through how to document this and discuss it with a tax professional.